Blog

News & Blogs

Latest News Feeds

Recent Post

Houston Home Sales Up in May Versus Last Year

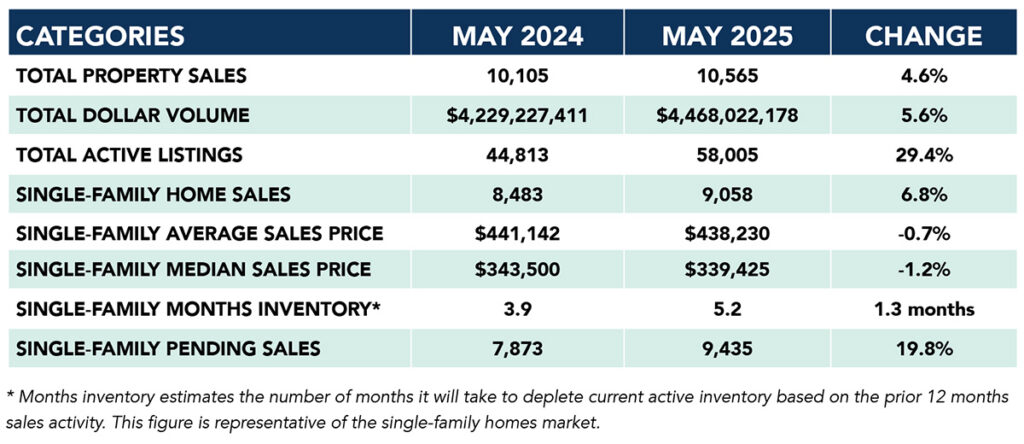

Houston Home Sales Up 5.4% in May

Home sales rose more than 5.4% in May with pending sales rocketing up 19.8%. With a more affordable median home price than Dallas or Austin, Houston may weather the trend of declining home prices better than most major Texas metros. Speaking of, the average sales price declined by 0.7 percent to $438,230 while the median price declined 1.2 percent to $339,425.

Active listings for single-family homes reached 37,455 in May, which is up 35.0 percent compared to last May. This volume represents the highest level of active listings since September 2007, when 37,500 units were on the market.

Available homes for sale also rose, up to a 5.2-months supply compared to 3.9 months of supply last May. This marks the highest level since July 2012. Nationwide, the average is 4.4 months of supply according to the National Association of Realtors.

Home sales in the Houston area performed as follows by specific price categories:

-

- $1 – $99,999: increased 23.8 percent

-

- $100,000 – $149,999: increased 18.6 percent

-

- $150,000 – $249,999: increased 12.0 percent

-

- $250,000 – $499,999: increased 5.7 percent

-

- $500,000 – $999,999: increased 0.2 percent

-

- $1M and above: increased 6.3 percent

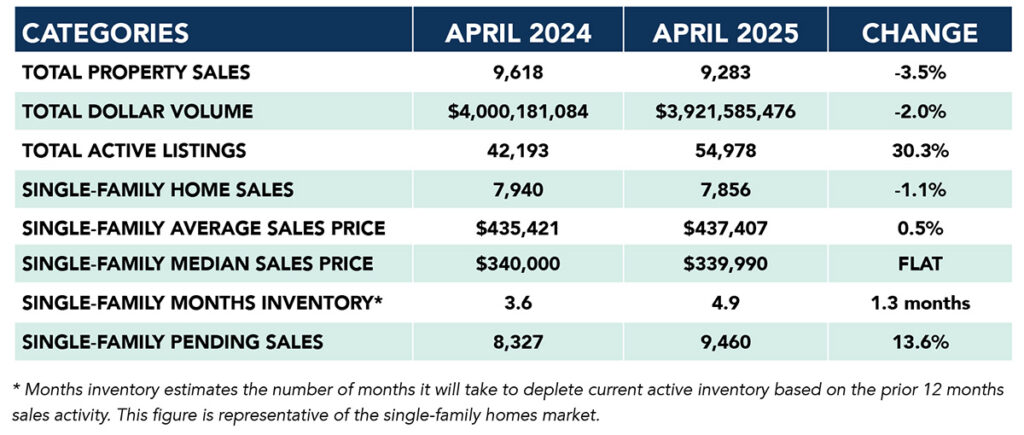

Houston Residential Pending Sales Jump In April 2025.

Houston Pending Home Sales Up In April.

Despite homes sales declining 1.1% versus a year ago, the future looks brighter as pending home sales in Houston jumped a healthy 13.6% versus a year ago. Anecdotally, it does feel like the phones are ringing a bit more. You also have to keep in mind that 2024 was the lowest number of nationwide home sales in almost 30 years, and 2023 was only marginally better. In other words, there has to be a lot of pent-up demand building when you have two plus years of anemic economic growth in the real estate market. Let’s hope we’ve finally turned the corner. Stay tuned!

How I started as a Land Broker in Austin County TX

How One Phone Call Led to Jumpstarting a New Area of Real Estate Business and a Great Friendship.

How are Houston and DFW New Homes Selling?

How Are New Homes Selling in Houston and DFW in the Last 30 Days? By Troy Corman, founder of t2 Real Estate To get a

20 Years That Changed Home Building

When Did Home Building by Craftsmen End? https://www.youtube.com/@BrentHullBrent Hull discusses the history of home building in the US, and how the focus on the mass

DFW July Home Sales Leap Over 2024

July DFW Home Sales Leap Over 2024. DFW area home sales rebounded with healthy gains over July of 2024. Collin County led the way with

Houston Home Sales Rise 9% in July

Houston Home Sales Jump 9% in July. 3By Troy Corman, Land Broker with t2 Real Estate For the third consecutive month, home sales in Houston

Coming Soon, Lower Interest Rates for the US.

Michael Lebowitz expecting lower rates. By Troy Corman, Land Broker with t2 Real Estate Michael Lebowitz joins Adam Taggart, on his Thoughtful Money podcast to

HAR Weekly Update From 3/25 to 3/31

Houston Association of Realtors reports that for the week of March 25 through March 31, 2025, new listings were up 40.6%, pending sales rose 3.4%, closings were down 9.9%, property showings up 9.7%, and listing views up 27.8% versus a year ago.

Texas Rural Land Report

Dr. Lynn Krebs Discusses Texas Rural Land Market.

Dr. Lynn Krebs with Texas A&M Real Estate Center discusses the ups and downs of the rural land market in Texas over the past few years and points out areas to get research on the Texas A&M Real Estate Center website. Click here to view the 2024 Q4 Texas Rural Land Report.

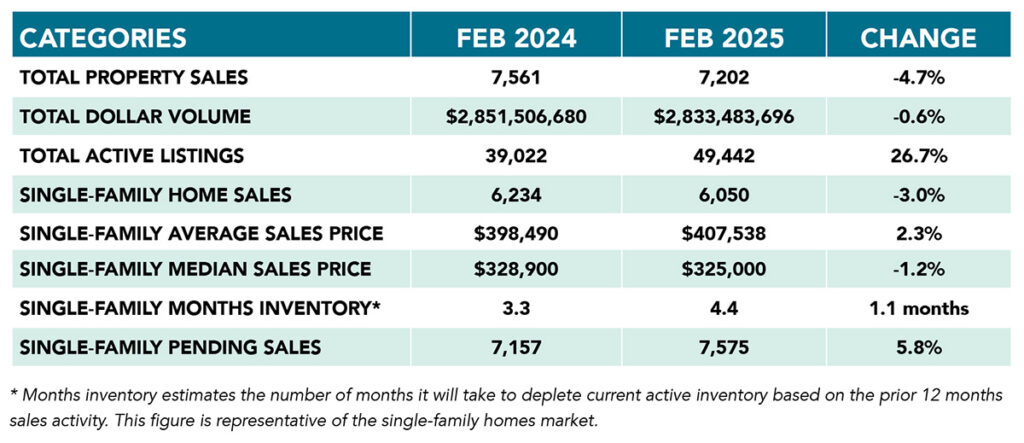

Houston Home Sales Cool in February

Houston Home Sales Cool in February.

Was it the cold weather that cooled Houston home sales in February? Time will tell. Total property sales in greater Houston declined 4.7% versus February 2024. Dollar volume decreased .6%. Active listings are up 26.7% annually. Single family homes for sale inventory rose to 4.4 months supply compared to 3.3 months of supply in 2024. The good news is that pending single family home sales rose 5.8% over last year.

Condos and townhome sales declined a whopping 21.9%. The inventory of townhomes and condominiums for sale expanded to 6.2-months, the highest level since June 2012.

Home sales by price category –

- $1 – $99,999: decreased 23.7 percent

- $100,000 – $149,999: decreased 6.9 percent

- $150,000 – $249,999: increased 2.0 percent

- $250,000 – $499,999: decreased 3.0 percent

- $500,000 – $999,999: decreased 5.6 percent

- $1M and above: increased 1.9 percent

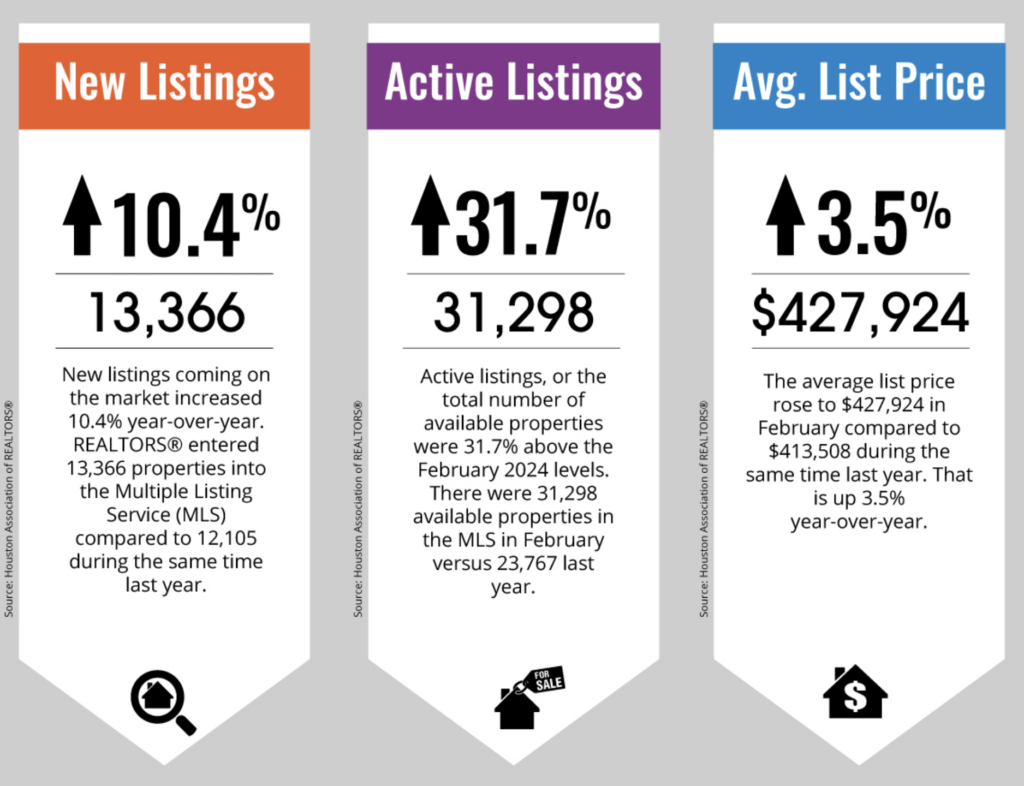

February 2025 Houston Housing Trends From the HAR Fresh Report.

February 2025 Houston Housing Trends From the HAR Fresh Report.

More properties were listed for sale in Houston in February 2025, with new listings up 10.4% versus a year ago. Active listings are now 31.7% higher than one year ago. The average list price rose to $427,924, a 3.5% increase over February 2024.