Blog

News & Blogs

Latest News Feeds

Recent Post

Redfin CEO Discusses 2025 Housing Outlook

Redfin CEO Glenn Kelman on Expectations for the Housing Market in 2025. (Video)

The Best Real Estate to Buy in 2025.

Video of the Best and Worst Real Estate to Buy in 2025.

Hear from Ken McElroy as he predicts the best and worst real estate to buy in 2025.

Houston November 2024 Residential Real Estate Statistics

Houston Residential Real Estate Statistics for November 2024 Versus A Year Ago.

Following robust sales growth in October, Houston residential sales increased again in November 2024 versus November 2023. Homes over $500,000 continue to outperform, as sales of homes priced over $750,000 and $1,000,000, increased 18%, and 24%, respectively.

Nov. Sold Homes Versus 2023 Median Price Price Vs. 2023

Single Family 6,559 +6% $329,900 +2%

Country Homes 169 -16% $379,500 -6%

Lots 541 -6% $95,000 +15%

New Homes 2,277 -2% $333,100 -1%

Sold Price Sold Homes % of Overall Volume Vs. 2023 Inventory

$100k-$149,999 132 2% -7% 4.1 months

$150k-$199,999 346 5.3% +17% 4.2 months

$200k-$249,999 851 18.0% +8% 3.5 months

$250k-$299,999 1,229 18.7% +5% 3.6 months

$300k-$399,999 1,771 26.1% -2% 4.4 months

$400k-$499,999 864 13.2% +7% 5.0 months

$500k-$749,999 843 12.9% +13% 5.0 months

$750k-$999,999 246 3.8% +18% 5.4 months

$1,000,000+ 244 3.7% +24% 6.0 months

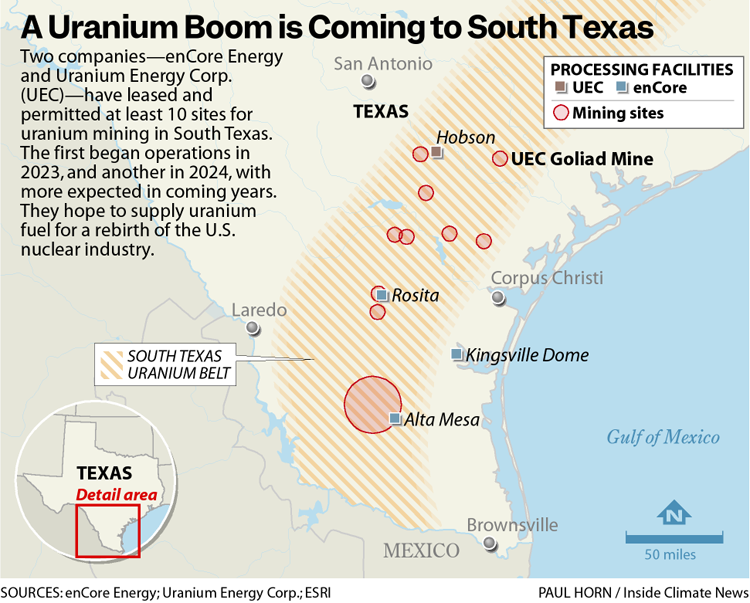

Uranium Demand In South Texas Concerns Locals

Nuclear Energy Has Raised The Demand For Uranium Mining In South Texas. Residents Are Concerned.

The demand for uranium to fuel nuclear energy has rekindled interest in both old uranium and new uranium mines in south Texas. While industry leaders say Texas could become the capital of nuclear energy, local residents are concerned that the uranium could leech into aquifers and contaminate the water. The mining area includes a large swath of Texas from Goliad county to the Rio Grande. The fear is that the uranium, arsenic, and radium stirred up during the mining process will drift from the sites, as the years go by. Read the full story here >

2025 Home Sales Forecast

Coach Carson and Lance Lambert Share Their 2025 Home Sales Forecast.

Residential real estate analyst Lance Lambert, with Resiclub Anayltics, and Coach Carson with One Rental at A Time discuss what they’re expecting for 2025 for the US residential home market.

Eric Basmajian says slowing construction job growth signals impending recession.

Eric Basmajian with EPB Research says the decreasing trend of residential and commercial construction employment signals an upcoming recession. The good news is that recessions force lower interest rates.